At the beginning of the COVID-19 crisis everyone in involved in the real estate industry held their breath to see what would happen with the housing market. Since the quarantine fell at the end of the first quarter, a slow down was anticipated in the second quarter.

Without fail, in the Oakland Park real estate market, from 2019 to 2020 there was a 36% decline in real estate sales. In simpler terms that means there was 82 less total sales in 2020 than during the second quarter of 2019. The good news was that the values held when it came to single family homes while condo values decreased only slightly.

Click here to see the full 2nd Quarter Real Estate Report for Oakland Park.

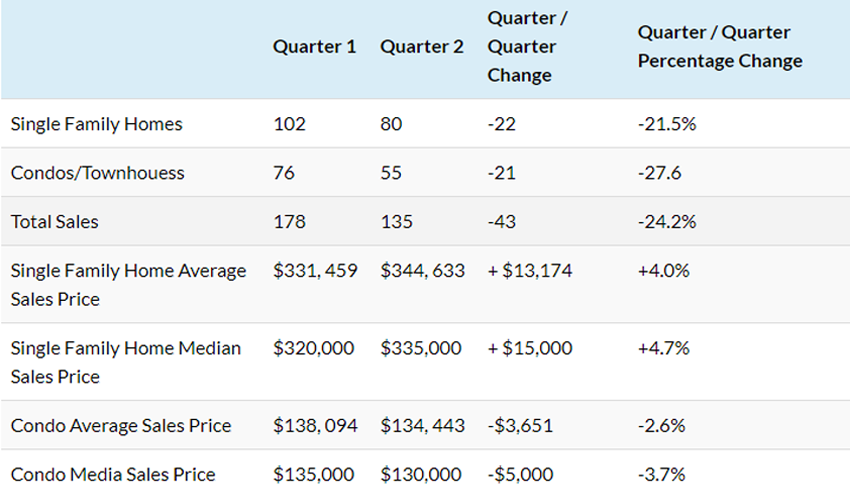

In Oakland Park from the first quarter of 2020 (178 total sales) to the second quarter of 2020 (135 total sales) there were 43 less total sales. There were 22 less single family home sales, and 21 less condo sales from the first quarter of 2020 to the second quarter of 2020. However, just as the year over year statistics showed the prices of single family homes not only held but increased. Condo values declined slightly but not enough to raise any panic alarms. See the table below for more specific data on the quarter over quarter change.

Q1 to Q2 Real Estate Sales in Oakland Park

*Data used to compile this table was taken from the MLS

Interest Rates Go Down

As everyone held their breath the Federal Reserve gradually began to lower interest rates in order to incentivize buying. The plan worked as homeowners and prospective homebuyers began to apply for refinancing and mortgage loans.

Billy Broyles, a loan officer for Fairway Mortgage, shared with LivingInOaklandPark.com that he has been non-stop busy since interest rates went down. Broyles further elaborated:

“Lower interest rates have led to more people seeking to loans for purchasing and refinancing. Our turnaround time for home loans was 10-12 days but with the increased volume it is now closer to 3 weeks“.

Buyer Demand Goes Up, Supply of Houses for Sale Low

On July 16th interest rates hit a record low, dipping below 3.0% for the first time ever (FreddieMac.com, 2020). The consequence of these continued lower interest rates is that they have incentivized even more potential buyers to seek loans for houses. This coupled with more stringent restrictions for loans means that those buyers that are out looking are highly qualified. While qualified buyers are running into a very low supply of homes on the market to choose from, for sellers it is a perfect storm.

A Perfect Storm For Home Sellers

The increased demand for homes plus stable home values means if a person has been thinking about selling, now is a good time to put their home on the market. The low inventory of available homes for sale has inevitably tipped the market in favor of Sellers. In a Sellers market scenario, such as the one that has emerged in the last few months, Sellers can command higher prices for their homes and be less flexible when it comes to negotiating terms.

That being said a house will only sell for the value it can it bear in the market. So while full price plus offers may come in, the house’s appraised value will ultimately determine the sale price. With this in mind, it is important for any Seller to carefully consider all terms proposed by potential buyers and be reasonable when negotiating.

Sources:

Freddiemac.com. (2020, July 16). Mortgage Market Survey Archive : Compilation of Weekly Survey Data for 2020. http://www.freddiemac.com/pmms/archive.html

One Response