The third quarter of 2020 real estate statistics are in! In this article we will be looking at how Oakland Park real estate fared during the third quarter of 2020 while we were deep into the quarantine.

When the quarantine first started we all held our breath; nobody knew how the housing market would react. The Fed dropped interest rates to the lowest ever, below 3%, and that spurred buyers to buy. Lenders also made their lending requirements more stringent, making the buyers that entered the market uber-qualified to buy. Sellers on the other hand wavered and many decided to pull their homes of the market. That left a low inventory of homes available for all the new and uber-qualified buyers.

The market which before the quarantine was balanced between buyers and sellers, all of sudden, switched back into a seller’s market as a result of the high demand for homes. There were less homes for sale and highly qualified buyers, so the market became extremely competitive.

Oakland Park Real Estate Sales Increase

The statistics for Oakland Park for the third quarter of 2020 clearly illustrate this trend. This was a dramatic upward shift from the second quarter of 2020 in which homes sales had dropped 36% from 2019. Albeit overall home values held.

In Oakland Park the third quarter of 2020 home sales went up 19% from the third quarter of 2019. But even more remarkable, this was a 77% increase in the total number of home sales between the second quarter of 2020 and the third quarter of 2020!

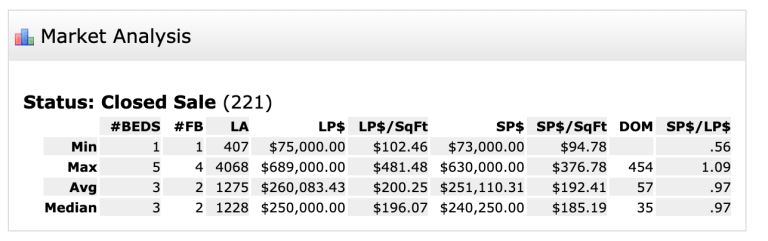

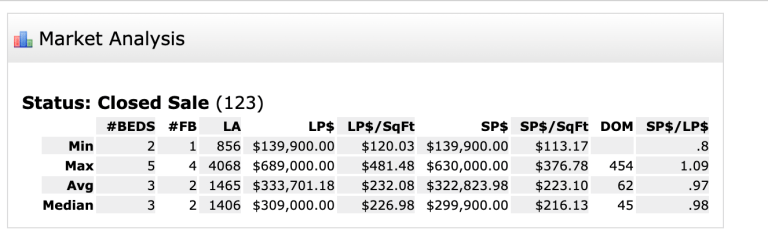

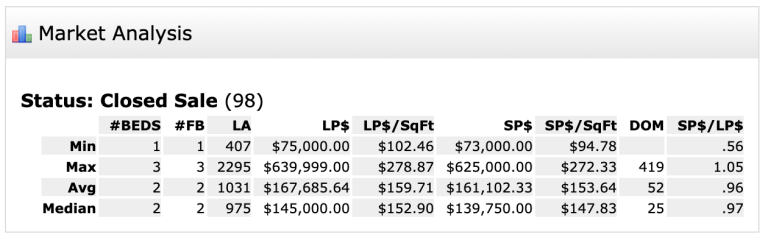

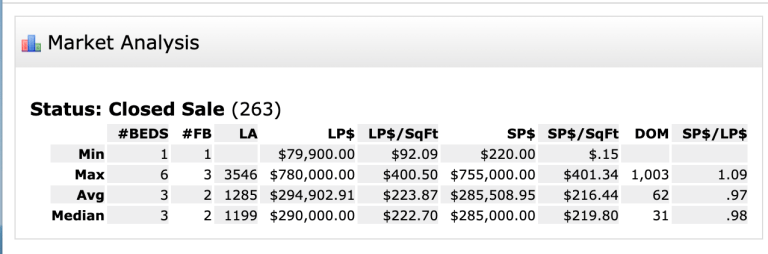

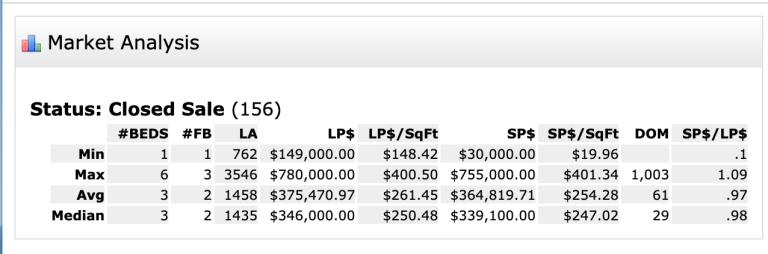

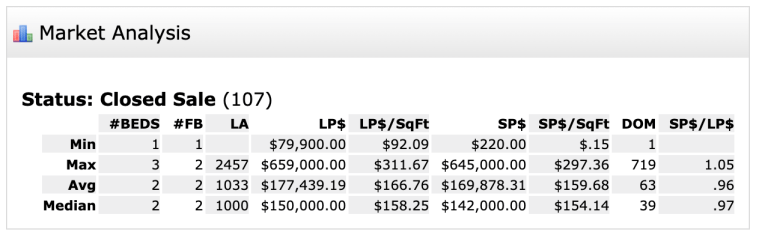

Across the board, in Oakland Park, property values went up between the third quarter of 2019 and 2020, with Single Family Homes experiencing the greatest increase. From 2019 to 2020 the average price of residential went up 13.6%, while the median increase was 18.75%. Single family homes on average went up 13% or approximately $42,000. The median value of single family homes also went up 13% or approximately $39,000. Condo/Villa/Townhouse prices went up an average of 5.5% approximately $9,000 while the median value went up 1.4% about $2000.

Have a look at the statistics below:

Statistics

Third Quarter 2019

- 221 Total Sales

Single Family Homes and Condo Sales Stats

- 123 Single Family Homes Sales Stats

- 98 Condo/Villa/Townhouse Sales Stats

Third Quarter 2020

- 263 Total Sales

Single Family Homes and Condo Sales Stats

- 156 Single Family Homes Sales Stats

- 107 Condo/Villa/Townhouse Sales Stats

The Best of Times, the Worst of Times

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us...”, so begins the classic tale by Charles Dickens, A Tale of Two Cities.

This quote seems appropriate here because we are certainly living in a time of uncertainty and things could change quite rapidly. Specifically, there are two things that, I believe, could influence the real estate market in the coming months. One is the inauguration of the president and the other is the end of the year long mortgage forbearance for many homeowners. So I urge us all to be cautiously optimistic.

Cautious Optimism

According to professor Heather Cox Richardson in her November 24, 2020 newsletter, when the president-elect mentioned that he planned on nominating Janet Yellen for the Treasury Department, the stock market jumped to a record high based on that news. Yellen, who is the first woman to be appointed for the position is a powerhouse in her own right.

An article in Politico described Yellen is a “widely respected labor economist” (Guida, 2020). A former executive at Goldman Sachs, Gary Cohn, who also served as the director for the National Economic Council under President Trump, said Yellen would be “the steady hand we need to promote an economy that works for everyone” (White, 2020).

This is great news but has to be balanced against an impending reality that may come to fruition early in the second quarter of 2021. That reality is that in March of 2021 many forbearance will come due. Homeowners do have the option to modify their loans to terms which will allow them to catch up. However, there may be many a homeowner that even with loan modification terms may not be able to catch up and therefore may have to sell their homes. Of those that opt to sell some may or may not have the equity to sell it as a normal sale, while others may have to opt for a short sale.

We don’t know how bad it may or may not be, only time will tell. As a result during this transitional period I urge cautious optimism as we enter 2021. Hope for the best, but be prepared, just in case!

References:

Guida, V. (2020, November 23). Biden to tap former Fed chief Yellen as first woman to head Treasury. Retrieved December 01, 2020, from https://www.politico.com/news/2020/11/23/biden-picks-janet-yellen-treasury-439760

White, B. (2020, November 24). What the Yellen choice means for Biden and the economy. Retrieved December 01, 2020, from https://www.politico.com/news/2020/11/23/yellen-treasury-secretary-democrats-440032