Oakland Park City Commissioners voted in a 5-0 vote, on first reading, to approve the tentative FY 2023 Millage Rate and OP City Budget at the September 7th meeting. This was the second of a 3-step process involving three separate meetings and votes: Proposed, Tentative, and then Final Millage Rate.

There was a subsequent special City Commission Meeting on September 12th dealing with non-ad valorem Special Assessments, described further in this article.

Millage Rate

The tentative operating millage rate would decrease from 5.8890 to 5.8550. This is the eighth reduction in the millage rate over the last nine years and is the lowest Milage Rate in over ten years.

2023 Budget

The 2023 budget was particularly challenging for City staff this year, given continuing revenue plateau changes and increased cost in maintenance needs for our existing City facilities. Also, supply chain difficulties continue to be a challenge along with record inflation, service costs and rising interest rates.

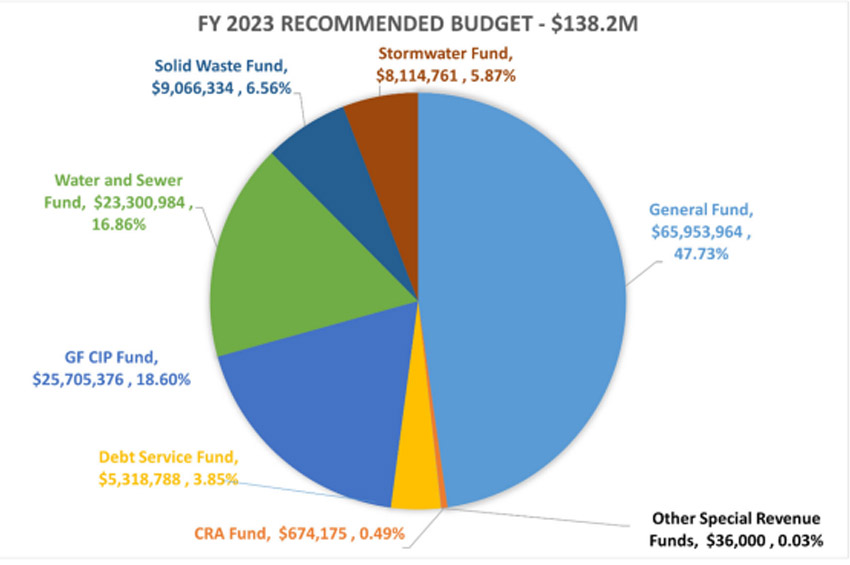

The tentative FY 2023 total city budget is $138,170.382. This total includes:

- $65,953.964 for the general fund;

- $25,705.376 for the GF CIP;

- $40,482.079 for Enterprise Funds;

- $710,175 in Special Revenues, and finally;

- $5,318,788.00 for Debt Service.

The General Fund Expenses of $65,953.964 is divided as follows:

- $18,233,441 for Police Services (BSO);

- $13,930,921 for Fire Rescue;

- $8,985,731 for Public Works;

- $3,722,890 for Parks & Leisure;

- $934,750 for Library & Cultural Services;

- $3,342.137 for Building & Permitting;

- $2,631,439 for Community Development;

- $1,780,084 for Engineering, and;

- $12,392.571 for General Government.

The Final Millage Rate and Budget will be presented and voted on during the September 21st Commission Meeting.

Non-ad Valorem Special Assessments

As mentioned above, a separate non-ad valorem Special Assessment hearing was held on September 12th at 6:00pm at City Hall to adopt the non-ad valorem Special Assessments described below.

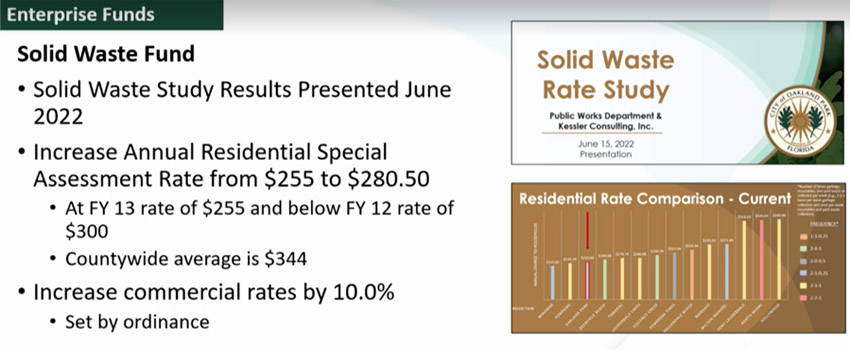

There are three non-ad valorem Special Assessments: Fire, Stormwater, and Solid Waste.

The Fire Assessment rate is being kept at $251.00 per residential unit, which is significantly below the county wide average of $311.00. There is an increase in the Stormwater Assessment rate from $84.00 per equivalent residential unit to $114.00. This is only the second increase since 2003. Lastly the Solid Waste Assessment rate is increasing from $255.00 to $280.50. This is still significantly below the county wide average of $344.00 as well as below the 2012 Oakland Park rate for this service at $300.00.

The Commissioners voted 5-0 to approve all three non-ad valorem Special Assessments.

Community Redevelopment Agency (CRA)

A separate Community Redevelopment Agency Meeting was held during the September 7th Commission Meeting to discuss and adopt the tentative CRA budget for FY 2023.

Oakland Park is a non-TIF (non taxing) CRA, meaning there is no rate setting action, simply the budget setting action. The CRA budget is funded by transfers from the City’s General Budget.

The CRA Board voted 5-0 to approve the CRA budget for 2023 of $674,175.00.

Additional Comments Presented by City Staff

Oakland Park has experienced its ninth consecutive year of property tax base expansion of 13.30%, one of the largest on record, and the eighth highest increase in Broward County. The City secured low interest rates on its bonds and loans for critical projects and has had enormous success in obtaining grant funding for capital projects.

There are several major private developments under construction right now throughout the City, valued at over $300 million.

The Final Millage Rate and Final 2023 City Budget, Capital Improvement Plan (CIP), Comprehensive Plan and Fiscal Policies will be held on September 21st at 6:30pm at City Hall.