How High Can It Go?

When I analyzed the Oakland Park real estate market last quarter, I found that the number of sales had pretty much remained the same compared to the last quarter of 2020. What had changed was the price at which homes were selling. A dwindling inventory, coupled with a very high demand, and low interest rates, sent prices soaring to heights never seen before.

The first quarter of 2022 compared to the first quarter of 2021 exhibited the same trend as the comparison for the last quarter of 2021/2020: number of sales remained the same, but the price of homes had skyrocketed. This upward trend is so significant it has many asking, how high can this market go? Let’s take a look and find out.

Statistics

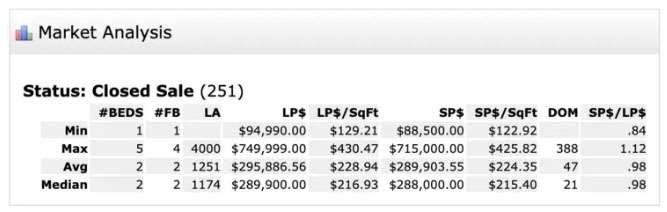

First Quarter 2021

- 251 Total Sales

Single Family Homes and Condo Sales Stats

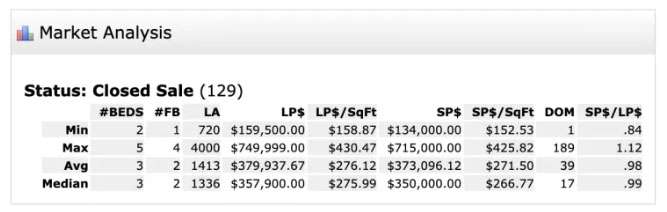

- 129 Single Family Homes Sales Stats

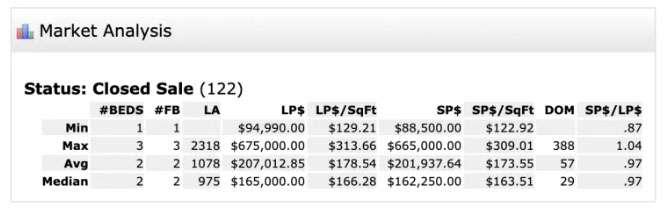

- 122 Condo/Villa/Townhouse Sales & Stats

First Quarter 2022

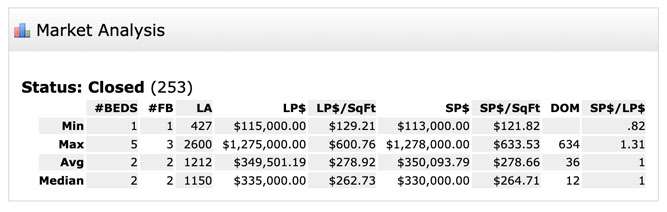

- 253 Total Sales

Single Family Homes and Condo Sales Stats

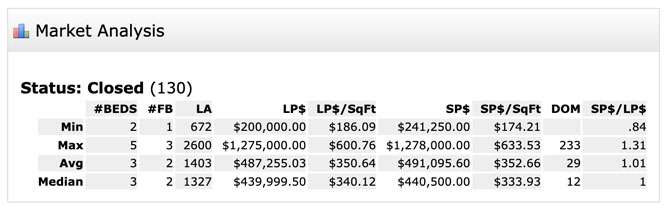

- 130 Single Family Homes Sales Stats

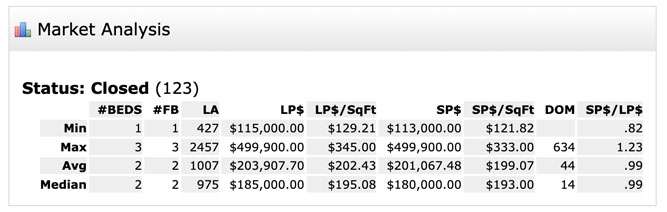

- 123 Condo/Villa/Townhouse Sales Stats

Final Analysis

From 2021 to 2022 sales went up a mere 0.7%. The average rise in home sale prices was 20.7% or $60,190 with a median rise of 14.6% or $42,000. Looking at the market as a whole, it is clear prices rose except for condos. The median price of condos went up nearly 11%, 10.9% to be exact. The average price of condos went down $870, with a negative average price of -0.4%. The most significant rise year over year was in the scarcest but most coveted product, single family homes.

All Real Estates Sales in Oakland Park 1st Quarter Comparison 2021/2022

| ALL SALES | # of Sales | Average Price | Median Price |

|---|---|---|---|

| 2021 | 251 | $289,903 | $288,000 |

| 2022 | 253 | $350,093 | $330,000 |

| Y/Y Difference | + 2 | + $60,190 | + $42,000 |

| Y/Y Percentage Difference | + 0.7% | +20.7% | +14.6% |

Single families became a highly coveted product during the pandemic. Many people began to work from home and for this reason sought out bigger houses in which they could live, work and play. In addition, there was increased immigration from other states, which led to a quickly dwindling inventory as buyers vied for houses.

As economist Adam Smith laid out in his iconic work The Wealth of Nations, when supply is low, and demand is high prices will go up. And up they went. Single family homes went up on average + $117,999! The median value went up too but not as significantly rising +$90,000. In plain English, in one year, in general, home values went up over 25%.

Single Family Home Sales in Oakland Park 1st Quarter Comparison 2021/2022

| Single Family Home Sales | # of Sales | Average Price | Median Price |

|---|---|---|---|

| 2021 | 129 | $373,096 | $350,000 |

| 2022 | 130 | $491,095 | $440,000 |

| Y/Y Difference | + 1 | + $117,999 | + $90,000 |

| Y/Y Percentage Difference | + 0.7% | + 31.6% | + 25.7% |

All Condo Sales in Oakland Park 1st Quarter Comparison 2021/2022

| All Condo Sales | # of Sales | Average Price | Median Price |

|---|---|---|---|

| 2021 | 122 | $201,937 | $162,250 |

| 2022 | 123 | $201,067 | $180,000 |

| Y/Y Difference | + 1 | – $870 | + $17,750 |

| Y/Y Percentage Difference | + 0.8% | -0.4% | + 10.9% |

As the upward trend continued this last quarter, people are asking themselves, how high can it go? Based on recent news, we may be reaching that peak. There are signs of a downward trend lurking in the background. I will analyze these trends in an up and coming article, so stay tuned. In the meantime, keep your eye on the market because it is the only way we will know how high it can go.